Overview

Start date: September 2026

Duration: 12 months (full-time only)

Fees for September 2026 intake: Home students: £48,250, Overseas: £48,250. Scholarships available.

Application deadline: Open on 20th October 2025 and close on 26th June 2026 at 5pm UK time for applicants who require a visa; and on 28th August 2026 for those who do not.

Entry: A quantitative undergraduate degree at 2:1 Honours (or equivalent) from a recognised university. International students, please note that UCL’s English language requirement for this programme is a ‘Level 2’ - further details regarding this can be found at the UCL English Language Requirements page.

Location: This programme is delivered at our Canary Wharf campus.

Apply to MSc Finance with Data Science

Programme

The Master’s in Finance with Data Science is a unique programme that combines the scientific foundations of finance with the theory and practice of rigorous financial data analysis.

Data science is becoming increasingly more important in the finance industry, as companies seek graduates whose main expertise is in finance but who also have a high level of data science literacy and skills. The Master’s in Finance with Data Science programme aims to equip you with the skills required to make data-driven decisions as a finance specialist and stand out in the job market.

The programme has been designed based on world-class research expertise in finance, data science, econometrics, and economics. It is highly quantitative combining theory and practice, delivered by leading faculty from the UCL School of Management and the UCL Department of Economics. Drawing on the knowledge and expertise of UCL’s academic staff, you will access a rich repository of expertise to navigate real-world challenges using financial market data.

The programme is well-suited for individuals who are passionate about finance. It will equip you with the skills and knowledge essential for positions in major global financial hubs such as New York, London, and Hong Kong- whether at a bulge bracket investment bank, hedge fund, or pioneering data-driven finance start-ups.

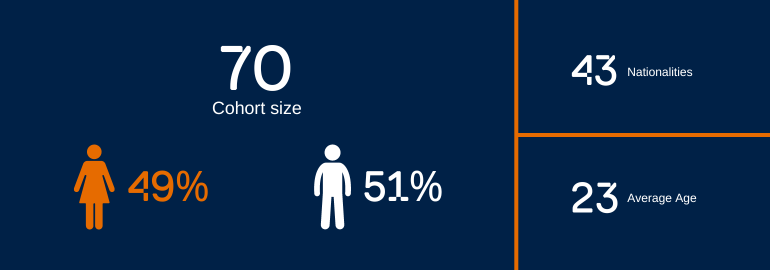

We aim to enrol a diverse global cohort of 70 students for the 2025–26 academic year. As this is a new programme launching in 2025, student data will begin with the first intake. However, the existing MSc Finance programme provides a useful benchmark for the type of cohort we expect to attract.

Programme structure

The programme’s unique intersection of finance and data science allows you to explore key financial topics such as the scientific foundations of finance (covering among others the economics of financial markets, firm capital structure decisions, and investment) and introduce you to financial econometrics and data analysis using the Python coding language.

An online pre-sessional course in mathematics, statistics, accounting and introduction to programming (Python) will be provided. These are designed to ensure all students are at the required level to maximise their learning outcomes from the outset.

You will study two core modules in Term 1, which delve into the scientific foundations of finance and introduce you to financial econometrics and data analysis using the Python coding language. No prior programming knowledge beyond the pre-sessional material is required.

In Term 2, you will study two additional core modules. They focus on frontier topics at the intersection of finance and data science: time series analysis and forecasting, and big data analysis and machine learning.

In Terms 2 and 3, you will be able to customise your learning experience by selecting the optional modules that best fit your interests and aspirations.

Finally, in Term 3 and during the summer, you will work on a concrete finance research project that will allow you to showcase the data analysis skills you will have acquired. In the process, you will be supported by topic-specific briefing and follow-up sessions.

The optional modules listed are subject to change each year and are indicative only. For questions about optional modules, please contact us at: mgmt-fds@ucl.ac.uk

MODULES

Programme for Students Starting Year 1 in September 2025

| Term 1 | Term 2 | Term 3 and over the summer period |

|---|---|---|

|

Compulsory Financial Econometrics and Data Corporate Finance and Financial Markets |

Compulsory MSIN0106 Time Series Analysis and Forecasting MSIN0208 Big Data Analytics Optional Options and Derivatives The Economics of Trading and Exchanges Advanced Corporate Finance |

Compulsory Finance with Data Science Research Project Optional Investment Strategies and Risk Management International Finance Behavioural Finance and Neuroeconomics |

Module content

For further information regarding the module content, please see the MSc Finance with Data Science 2025 Indicative Module Content Guide.

Please note that the list of modules given here is indicative. This information is published a long time in advance of enrolment and module content and availability are subject to change. Modules that are in use for the current academic year are linked for further information. Where no link is present, further information is not yet available

Teaching Methods and Typical Contact Hours

The programme is delivered through a combination of lectures and interactive components. Assessment is through written examinations, individual/group coursework, and a 6,000-word research project.

In Term 1, there are two 30-credit modules. They are delivered over 10 weeks during which there are typically 6 contact hours per module (please note that this also includes practical sessions). In Term 2, both compulsory and optional modules bear 15 credits and are delivered over 10 weeks, with typically 3 contact hours per week per module. Optional modules in Term 3 are delivered over a period of 5 weeks, with typically 6 contact hours per week.

In addition, students spend approximately 7-12 hours a week for each 15-credit module (and twice as much on the 30-credit modules) on assessment and independent study to further develop the skills and knowledge covered in lectures and practical sessions.

The total number of weekly hours will vary according to the module and the weekly activities being undertaken.

How is this Programme Unique?

This programme is data-driven throughout, and you will work extensively with real-world financial data (e.g., from Bloomberg terminals and Refinitiv), which you will handle and analyse both with basic software such as Microsoft Excel and with Python. This will help you to develop the skills required to analyse real-world problems and phenomena through an economic modelling lens and combine econometric methods and economic insight to produce data-driven solutions to finance problems.

Upon completing the programme, you will be equipped with the skills of a finance specialist with a high level of data science literacy to collect and manipulate data and use it to perform formal analysis and produce reports using data visualisation, all of which can inform strategic decisions within a financial organisation. You will be able to demonstrate critical thinking and problem-solving ability in the context of questions related to finance, a skill sought out by employers in the global finance industry.

UCL is also a CQF Institute University Partner. The CQF Institute, the awarding body for the Certificate in Quantitative Finance, is a leading quantitative finance membership organisation with members in over 90 countries worldwide. This institute partnership offers a wide range of additional resources, workshops, industry insight sessions, conferences and networking opportunities as a student on the programme.

Why choose UCL?

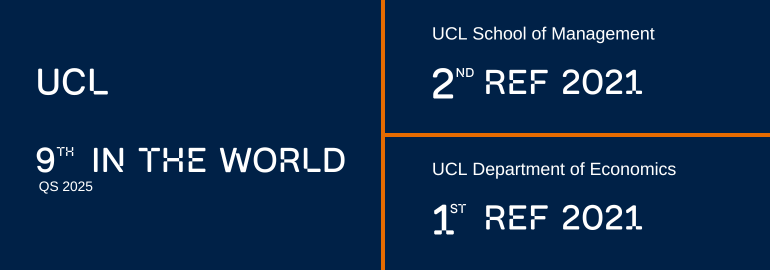

UCL is one of the world’s best universities, consistently placed in the global top 20 in a wide variety of world rankings.

The programme is delivered jointly by the School of Management and the Department of Economics.

UCL School of Management offers carefully designed programmes to prepare future leaders in the next generation of innovation-intensive organisations. The majority of the research carried out in the UCL School of Management was rated as “world-leading” and “internationally excellent” in the 2021 Research Excellent Framework (REF), placing us second in the UK for business and management.

The UCL Department of Economics has an outstanding international reputation in key areas of current research. The Department ranked top in the UK for research environment and outputs in the field of Economics and Econometrics in the 2021 Research Excellence Framework. The REF has placed UCL Economics first for 4* world-leading research outputs and research environments, with scores of 72% and 100% respectively. The Department also placed third in its overall ranking with 65% of all indicators ranked as 4*. The Department provides students with an in-depth knowledge of cutting-edge techniques in theoretical and applied economics, utilising robust quantitative underpinnings.

Applications

Designed for individuals with a robust quantitative and mathematical background, the MSc in Finance with Data Science is the ideal programme for those pursuing a high-profile career in quantitative finance or who wish to advance on an established path within the sector.

As an MSc Finance with Data Science student, you are expected to have a strong quantitative background. No prior knowledge of coding is required, but you should be highly motivated to develop these skills right from the start of the pre-sessional module. With this in mind, we expect a great deal from our students, so if you choose to study with us, you can expect to be working hard, challenging yourself as we challenge you and regularly finding yourself outside of your comfort zone.

Our students come from a range of academic backgrounds, including economics, finance, mathematics, econometrics and statistics. Degrees from other disciplines may be considered provided the background is sufficiently quantitative.

Meet us at an Event

If you’re considering applying to one of our programmes and would like to discuss your eligibility, you can meet a member of the Student Recruitment Team at an event in a city near you.

Click below for upcoming events, booking 1:1 appointments with the Student Recruitment Team, and how you can connect with us.

MSc Finance with Data Science Virtual Open Day 2025

Master the intersection of finance and data science. Join us for an exclusive look at the UCL School of Management’s MSc Finance with Data Science – a unique programme that equips you with advanced financial expertise alongside high-level data science literacy and coding skills.

In this virtual open day, discover:

- Scientific foundations of finance combined with rigorous data analysis

- Programming skills in Python for financial applications

- Real-world experience with Bloomberg terminals and Refinitiv platforms

- Specialist modules in time series analysis, machine learning, and big data analytics

- Career opportunities in banking, asset management, fintech, and regulatory bodies

This programme prepares graduates to stand out in a competitive job market as finance specialists with exceptional data science capabilities.

Questions answered in this session:

- What programming skills will you learn?

- How does the research project apply data science to finance?

- What careers do graduates pursue?

- Ideal background and entry requirements

Application Process

Applications open on 20th October 2025 and close on 26th June 2026 at 5pm UK time for applicants who require a visa; and on 28th August 2026 for those who do not.

Programmes are competitive so students are advised to apply as early as possible.

Apply to MSc Finance with Data Science

Entry Requirements

We look for students with drive, intelligence, passion, and the right aptitude. To ensure we enrol students who meet these criteria, we use the following methods to assess applications.

A quantitative undergraduate degree at 2:1 Honours (or equivalent) from a recognised university. International students can find their international equivalency on the UCL international students website.

Degrees in economics, finance, mathematics, econometrics and statistics are preferred. Degrees in related fields are also considered provided they are quantitative enough.

GMAT/GRE

GMAT/GRE are not required for MSc Finance with Data Science.

However, an outstanding GRE quantitative score (165+) adds weight to your application.

English Language Requirement

The English language level for this programme is Level 2.

Further information can be found on our English language requirements page.

CV

Applicants are required to submit a CV. Please make sure to provide all relevant and accurate information (exact degree title, beginning and end dates, location for professional experience, etc.)

Personal Statement

Submitting a personal statement is not required, but can be used if you wish to communicate specific information to the admission committee.

Interview

Applicants who meet the entry requirements will be reviewed. Those considered eligible for the next stage will be invited to an online video interview, with the invitation sent by email from Kira Talent.

Not sure which programme is for you?

Choosing the right programme is essential for a successful application and to ensure you maximise your time with us. We also offer an MSc Finance programme, which is a more generalist programme. The key differences are summarised in the table below.

|

|

MSc Finance with Data Science |

MSc Finance |

|---|---|---|

| Typical applicant | Aspiring finance professional with a passion for data and the will to develop cutting-edge data science and econometric skills. | Aspiring finance professional with broad interests. A typical first job title will be Financial Analyst and many graduates will aspire to taking the full sequence of CFA certification rapidly. |

| Balance and focus | A specialist finance degree that aims at providing a very high level of data science literacy. | A generalist finance degree that balances scientific foundations and the practice of finance. |

| Entry requirements | 2:1 (first preferred) | 2:1 (first preferred) |

| Quantitative skills | Outstanding quantitative skills | Excellent quantitative skills |

| GRE/GMAT | Not required, but outstanding GRE quantitative score (165+) adds weight to the application. | Not required, but strong GRE quantitative (162+) or overall GMAT or GMAT Focus (at least 80th percentile) scores add weight to the application. |

| Key features | Almost all modules involves dealing with real-world financial data (from sources such as Bloomberg terminals, Refinitiv, etc.) | Outstanding coverage of CFA topics (95% of CFA Level 1 and 80% of CFA level 2). |

| Target jobs | Graduates will typically place in a financial company, in roles that are more quantitative than MSc Finance graduates, and with a large expected exposure to computer and data scientists. Some examples: Credit Analyst (e.g., in a credit rating agency), Portfolio analyst (pathway to become a Portfolio Manager in any asset management company), Quantitative Analyst (e.g., in a hedge fund), Risk Analyst (e.g., in a clearing house), Investment Analyst (in any finance boutique), or even Financial Engineer (e.g., in an investment bank to design structured products). | Graduates will typically place in a financial company, but will also have opportunities at finance departments of non-financial companies. In both cases, roles are likely to be more of a generalist nature with less intense data exposure. Typical examples will be Financial Analyst or corporate analyst at commercial or investment banks, but graduates will also have ample opportunities at mutual funds, hedge funds, and other financial firms. |

| Affiliations | UCL, through this programme, is a University Partner for the CQF Institute, which provides networking opportunities and career resources for those pursuing a career in quantitative finance. | UCL, through this programme, is a CFA® affiliated university, entitling students to apply for scholarships to reduce exam and registration fees. |

Which Programme is Right for you?

Watch our MSc Finance and MSc Finace with Data Science animated explainer video to see the differences between the two unique programmes and help you decide which is the right one for you.

Tuition Fees and Scholarships

Tuition Fees

The 2025-26 fees will be £47,100 for UK and Overseas students. Learn more about tuition fees.

Scholarships and Funding

Scholarships will be awarded to candidates in one of the following four categories:

- Women in Finance Scholarship – Scholarships will be given to outstanding female candidates who apply to the programme.

- Global Finance Scholarship - Scholarships will be given to outstanding candidates applying to study from a Latin American or African country.

- The Excellence Scholarship – Scholarships will be given to outstanding candidates who submit an excellent application, demonstrating academic merit, strong professional or community experience, leadership potential and a clear career plan.

All applicants who apply to the programme for September 2026 entry will be automatically considered for the above scholarships, and our admissions teams will be in touch if you have been chosen.

- The Impact Scholarship – Scholarships will be given to outstanding offer-holders from lower-income backgrounds.

This scholarship will have a separate application process. All offer-holders will be contacted in March 2026 with details of how to apply. Later applicants to the programme are unlikely to be considered in time for this scholarship.

The Fullbright Commission Award is available for a US graduate student or those with equivalent experience in a relevant field to study the Business Analytics MSc. Please note this is only available to citizens of the United States of America. Further details on the Fulbright website and the Fulbright US Student Programme website.

Additional Costs

Careers

The Careers service offered to MSc Finance with Data Science students at UCL is designed to help you build a strong foundation for early success in your career. Through a combination of tailored support, employer engagement, and alumni connections, you’ll graduate equipped with the skills and confidence to thrive in your chosen field, regardless of your background, nationality, or prior experience.

For further information on the Careers provision for UCL School of Management, please see our Careers page.

Dedicated School of Management Careers Support

As an MSc Finance with Data Science student, you’ll benefit from bespoke Careers support delivered by a specialist careers team. This includes:

- One-to-one career coaching with professionally-certified, industry-focused Careers Consultants

- Access to our global alumni network who are keen to offer advice and guidance

- Online resources which can be accessed on-demand to support your career journey

- A Careers and Professional Development (CPD) Programme for PGT students.

At the centre of the CPD programme is a series of weekly in-person and online sessions in the Autumn and Spring terms spanning two streams of sector focus:

- Finance, Accounting and Banking

- Management, Analytics and Business.

By taking part in these career streams, you will participate in:

- Recruitment Readiness workshops to prepare for the graduate recruitment cycle.

- Industry Insights events to connect with alumni and recruiters in School of Management.

- Skills Shaping sessions to develop the transferable and technical skills employers value.

UCL Central Careers Resources

In addition to the School of Management’s tailored support, you’ll also have access to UCL Careers’ extensive resources. Each year, hundreds of employers participate in UCL Careers events, including:

- Careers fairs and employer presentations

- Sector-themed weeks with networking opportunities and expert panels

Where our Graduates Work

Our graduates pursue global careers across a wide range of roles, sectors, and geographies. Popular sectors include Consulting, Banking and Finance, Marketing, Technology, and Data & Analytics.

For more information and statistics on where our graduates work, you can view the most recent data available from the UCL Graduate Outcomes Survey.

Contact

For further information regarding the MSc Finance with Data Science, please contact the Postgraduate Team. mgmt.fds-admin@ucl.ac.uk

For further queries regarding admissions please see the UCL Postgraduate Admissions Webpage.

Want to experience student life from our campus in the clouds?

Grab your spot on one of our upcoming Canary Wharf Campus Tours!

We recommend you register early as spaces are limited.

Other programmes of interest

UCL and the UCL School of Management offer a range of finance and data science-related programmes, while this programme is unique in combining the two, please note other programmes that may be of interest to you.

Programmes delivered by the UCL School of Management

Programmes delivered by UCL’s Computer Science department

Video Library

Register for more information

For more information on the new programmes or simply to sign up to receive news from UCL and the UCL School of Management, please register your interest using the form below.

FAQs

You may apply now for a place on a programme without a current English test as long as you send your qualification as soon as you receive it. If you are offered a place, it will be conditional on you providing evidence of meeting UCL’s English Language Requirements before the start of the programme.